By Ellen Foell, Legal Counsel

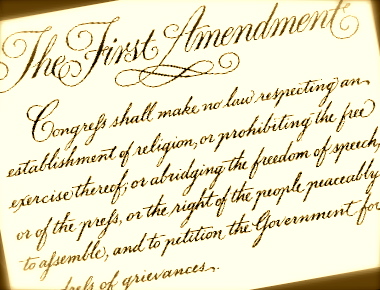

I know it is no longer fashionable to think that the First Amendment has any punch or power, but I like to hold onto such beliefs. You remember what it says, right?

Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances.

Direct and Grassroots Lobbying

“Petition the government for redress of grievances” is a fancy way of saying “lobbying.” In general, lobbying is simply stating your position on specific legislation to legislators or other government employees who participate in the formulation of legislation. It can also mean urging your elected representatives to do so on your behalf, which is known as direct lobbying.

Lobbying includes stating your position on legislation to the general public and asking the general public to contact legislators or other government employees who participate in the formulation of legislation. This is known as grassroots lobbying.

What about non-profits?

Here’s something that may come as a shock: 501(c)(3)s are permitted to lobby. That means your center is permitted to lobby. In fact, to fulfill your center’s mandate and mission, your center and its members should be lobbying.

Federal tax law and the IRS regulations permit some lobbying by nonprofits, as long as that lobbying meets two criteria:

1. The time and money spent on lobbying by the 501c3 falls within IRS limits;

2. The activities engaged in by the organization fall within IRS definitions of lobbying.

How much can a 501(c)(3) organization spend on lobbying?

A 501(c)(3) that has not filed for the 501(h) election is limited to spending an insubstantial amount of time, expenses and activities on lobbying. Insubstantial has never been defined by the IRS, but certainly 5% is generally considered a safe amount of time and money.

A center that has taken the (very easy!) step of filing a 501(h) election with the IRS operates under a different set of rules. In that case, a center would be subject to the following limits:

|

If the amount of exempt purpose expenditures is: |

Lobbying nontaxable amount is: |

|

≤ $500,000 |

20% of the exempt purpose expenditures |

|

>$500,00 but ≤ $1,000,000 |

$100,000 plus 15% of the excess of exempt purpose expenditures over $500,000 |

|

> $1,000,000 but ≤ $1,500,000 |

$175,000 plus 10% of the excess of exempt purpose expenditures over $1,000,000 |

|

>$1,500,000 |

$225,000 plus 5% of the exempt purpose expenditures over $1,500,000 |

What activities are considered lobbying?

The law also makes it clear which activities are lobbying and which are not. For example, lobbying occurs only when there is an expenditure of money by the 501(c)(3) for the purpose of attempting to influence legislation.

Centers are permitted to ask members and donors as well as the general public to support or oppose specific legislation. Centers are permitted to announce the legislation in a publication and ask readers to take action.

A 501(c)(3) organization may inform a political candidate of its positions on particular issues and urge him/her to go on record, pledging support of those positions. A center director can also mention the legislation when speaking at a church and encourage action.

Further, centers are allowed, without limit, to educate people on the legislation without encouraging action, to advocate involvement in the political process, and to pray regarding the legislation.

If the IRS had a deduction specifically for the benefit of pro-life individuals (which it does not), wouldn’t you as an individual, take advantage of it? Well, the IRS permits your organization to lobby, within limits.

Take advantage of it.

In the case of pro-abortion bills H.R. 2030 and S.B. 981, the mission, well-being, and very existence of your center may very well depend upon it.